Bitcoin, Etherum, and other virtual currencies provide crypto investors a way to shield their income from the Internal Revenue Service. According to tax experts, the Federal Government is blind to transactions due to lax reporting demands. To close the tax gap, the Biden administration is looking at ways to alter the current rules in an effort to fund the government’s American Families Plan.

As it stands, virtual currencies such as Bitcoin and Ethereum provide crypto investors a way in which they can shield any income derived from crypto-trading from IRS authorities. Right now, the crypto economy, valued somewhere near $2 trillion, is a major contributor to the difference between the amount of tax paid vs. the amount of tax owed, known as the “tax gap.” It is suggested that the gap could increase to $7 trillion over the next 10 years.

The concern on the part of the Treasury appears to focus on wealthy individuals who, to avoid paying tax, shift taxable assets into the crypto economy.

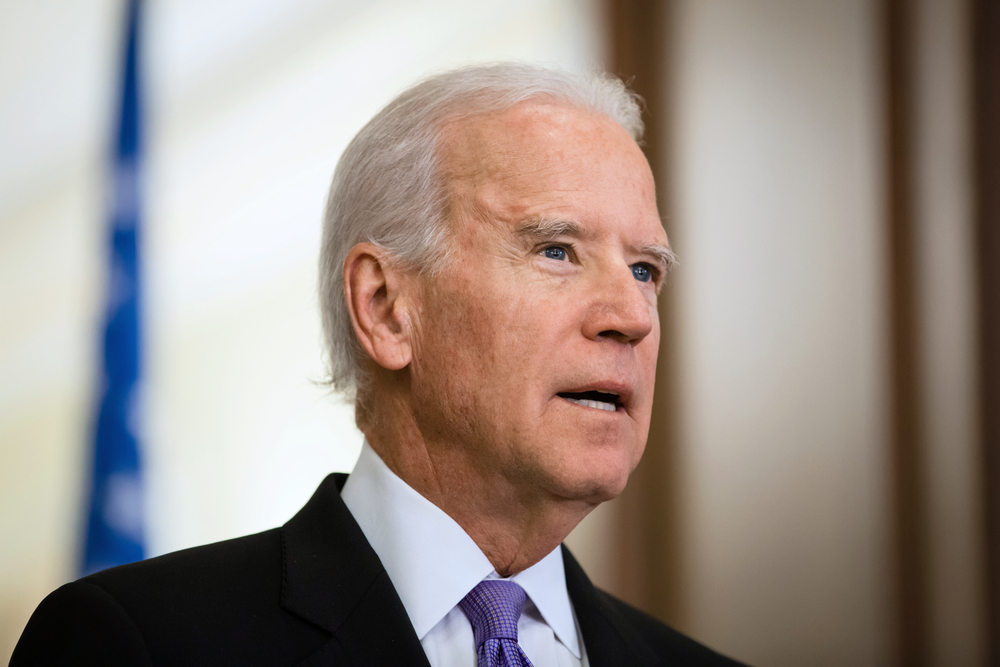

The Biden administration has recently outlined a tax-compliance agenda. According to the authors, crypto is posing a detection problem by facilitating tax evasion.

Cryptocurrency Tax Evasion

How does crypto lead to tax evasion?

According to well-known tax experts, the problem appears to be lax reporting requirements. If crypto transactions are not reported by exchanges or other third parties, the IRS would have great difficulty tracing them, or the income generated. This results in a situation where income on the transaction is not being reported, hence, tax is not being paid.

A former IRS litigator, now a partner in the law firm Baker Botts, says, “There have been no clear rules issued, this results in a great deal of unreported activity.” Mr. Feldhammer went on to say that when a path of non-reporting has been created, there is a way to benefit from tax fraud.

There is little doubt that cryptocurrencies are fast becoming a cash alternative. More and more vendors are accepting Bitcoin and other virtual money as payment for goods or services. However, cash is more heavily regulated than crypto.

An Example

A business entity that receives cash in the amount of $10,000 or more from a customer is obliged to file a “currency transaction report.” A good example of this is a consumer buying an automobile for more than $10,000 in cash. Other examples would include hitting the jackpot in a casino or a bank taking a large cash deposit.

The objective of the report is to advise the government that the person who consummated the transaction has plenty of cash that may, or may not, have been reported to the IRS.

The same rules that apply to cash, do not apply to crypto. If the same car dealer were to receive $20,000 of Bitcoin for the purchase of a car, he or she does not have to report a large currency transaction. In the event the income is not reported, the income may go untaxed.

Although cryptocurrency transactions constitute a relatively small proportion of business transactions today, transactions of this nature are likely to increase in volume and importance over the next decade.

President Biden’s Crypto Proposal

It is estimated that some 80 percent of the “tax gap” in the United States is due to under-reported income. According to the IRS, this is more prevalent among the wealthy who bury income in opaque structures.

The report noted that among the most effective ways to improve tax collection and compliance was to implement stronger standards for reporting, including the reporting of cryptocurrency assets.

The tax agenda as proposed by the Biden administration would treat transactions consummated in crypto no different than had the transaction been cash. This would require that businesses report transactions when the amount was more than $10,000 in virtual currency, as well as real currency.

Under this proposal, banks, digital asset exchanges, and custodians of crypto would be required to report transactions over a yet to be determined threshold.

The IRS is keen to learn about the cryptocurrency activity of taxpayers. The 2020 tax return included a questionnaire about the individual’s crypto holdings.

To become law, the proposals put forward by President Biden would have to receive Congressional approval. It is estimated the plan would raise $700 billion in the first 10 years and $1.6 trillion in the second decade, according to treasury calculations.

ChesWorkShop commits to presenting fair and reliable information on subjects including cryptocurrency, finance, trading, and stocks. However, we do not have the capacity to offer financial guidance, advocating instead for users to conduct their own diligent research.