KBW Maintains Live Oak Bancshares Market Perform

KBW, a leading investment bank specializing in the financial services sector, has recently released a report maintaining its assessment of Live Oak Bancshares’ market performance as “market perform.” In this article, we will delve into the in-depth analysis provided by KBW and explore the factors that have influenced their assessment. This evaluation is crucial for investors seeking a comprehensive understanding of Live Oak Bancshares’ current position in the market.

In-depth analysis of KBW’s assessment of Live Oak Bancshares’ market performance

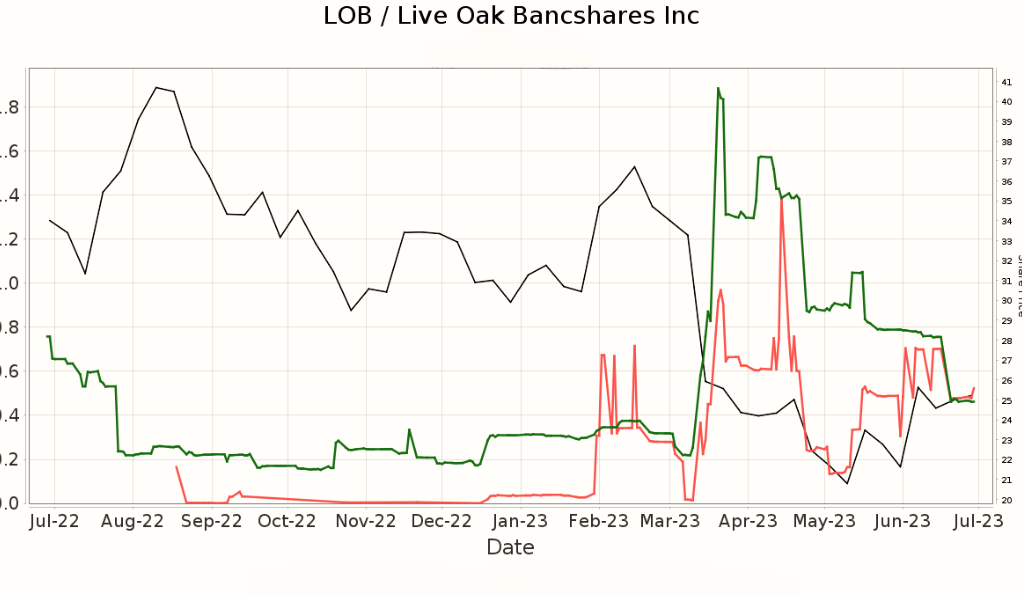

KBW’s rating of “market perform” suggests that Live Oak Bancshares is expected to perform in line with the average performance of the overall market. This analysis takes into account numerous factors, including the company’s financial health, growth prospects, competitive position, and the broader economic environment.

One key aspect that KBW focused on in their assessment is Live Oak Bancshares’ financial health. The bank’s financial statements, including its balance sheet and income statement, were examined to evaluate its liquidity, solvency, and profitability. Additionally, KBW considered Live Oak Bancshares’ ability to manage its loan portfolio effectively and mitigate credit risks, as well as its capital adequacy and overall risk management practices.

KBW also took into consideration Live Oak Bancshares’ growth prospects. This includes the bank’s ability to attract new customers, expand its loan and deposit base, and diversify its revenue streams. Furthermore, KBW examined the bank’s strategic initiatives, such as its digital banking platform and partnerships, to assess their potential impact on growth.

Conclusion

KBW’s maintenance of Live Oak Bancshares’ market perform rating indicates that the bank is expected to perform in line with the general market trends. The in-depth analysis provided by KBW considers various factors, including Live Oak Bancshares’ financial health and growth prospects. Investors can use this assessment as a valuable resource to make informed decisions regarding their investments in Live Oak Bancshares. It is important to note that market conditions can change, and investors are advised to regularly monitor the company’s performance and any updates from KBW to ensure their investment decisions align with their goals and risk tolerance.

ChesWorkShop commits to presenting fair and reliable information on subjects including cryptocurrency, finance, trading, and stocks. However, we do not have the capacity to offer financial guidance, advocating instead for users to conduct their own diligent research.